Generally your home is your most valuable asset, so you take measures to make sure it is fully protected with homeowners insurance. The reason you buy homeowners insurance is so that your property does not get depreciated in the event of a problem. A standard homeowners policy, also known as an HO3, insures against the basics like fires and theft. However, an HO3 policy has compensation limits and that can leave gaps in your coverage.

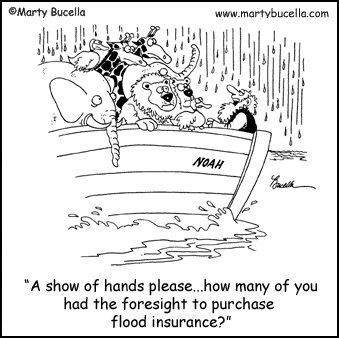

Homeowners insurance covers water damage coming from the inside of a house, such as a broken pipe. Many people are not aware that a homeowner’s insurance policy does not include flood coverage, water coming from the outside surfaces or underground. Flood insurance is a separate policy that covers your property and/or contents against storm surges and flooding during torrential rains, hurricanes, and tropical storms. Flood insurance is typically provided by through the National Flood Insurance Program, but it also can be obtained through the open market: contact your insurance agent to learn more. I’ve read that there is a 30-day waiting period required before a flood policy will go into effect, so it is important not to buy this coverage at the last minute. Lol, I know it’s late for me… my garden pump house is flooded. And because it was a low risk of flooding, I chose not to buy flood insurance. Go figure, for a 10 x 14 little box. It did fine for 30 years. For many others though, there’s more crucial circumstances involved right now. I think many of you may have stories so feel free to share them here. It would be fun to hear your flooding stories and we could post a page on home owner flooding of 2017.

Next…

Make sure your policy covers the cost of rebuilding and refurnishing your entire home. This is very important. Time and time again I come across insurance jobs that short cut the home owner because of the policy coverage.

- To do so, have a homebuilder come and give you an estimate for how much replacement coverage you would need.

- Once you know the replacement cost of your home, you can start to weigh your options.

- The first, and most popular, is called "extended replacement coverage." This generally expands your payout limit to about 125 percent of your home's value. Some policies offer an inflation guarantee. This makes sure the amount of coverage stays current with repair costs and your home's current market value. If you have both of these policies, you should be in good shape.

- Don't forget your personal possessions: You may want an additional policy to cover specific items, or you can add them to your homeowners insurance.

- Understand exclusions in your policy. Take the time to understand from a comprehensive level what is and is not covered.

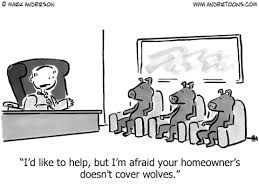

- Who is living in your home directly determines the type of policy you should have. There is a different policy for people who own and live in their home as opposed to people who own a home that they are renting, or even people who own a home that nobody lives in. In some instances, your claim won’t be covered if you have the wrong policy based on the occupancy of your home.

- Make sure that your “cheap” policy isn’t less expensive because important coverage has been removed or because the company has inadequate reinsurance.

- Older homes should always have “ordinance of law” coverage code upgrade.

- Finally, as with all insurance policies, consider your deductibles. I suggest you opt for the highest deductible you can afford, which will lower your premiums. A bottom line to consider in dealing with insurance companies on your home is that they don’t make money by paying you money. So many times you can end up with a cat and mouse game that boils down to persistence on the contractor or homeowner’s part. Adjustors will try to minimize claims and many homeowners don’t understand what it takes to actually put something damaged back together again. Adjustors will attempt to settle claims very quickly by coming out to your house, look at the damage then write you a check on the spot. The trouble with this method is that there could be, and many times is, further interior damage than with what meets the eye. You really should have a licensed contractor look at the damage first, whether it’s fire damage, water damage or other. The contractor will give a more balanced perspective and expert advice on the real damage. And know your insurance policy. For example on my daughter’s house, she had part of her roof ruined during the ice storm in Oregon. A tree fell on part of her roof, and the insurance company would only repair the damaged area. Her shingles were 15 years old, so when they patched the spot that was damaged, you can see that it doesn’t match the old shingles. Her house was depreciated because of that. You have to know what your policy states, and her policy did not cover one-half of the roof, which is what should have been done.

Insurance companies will cover damages on a one-time problem. There was an ice dam at a house, and water came in the wall and ruined the flooring. When we got in there we found out that inside the wall was saturated, the sheeting had separated and there was black mold growing in there. Because that black mold was years old, it became a maintenance issue so the insurance company would repair the damage caused by the ice dam this year – floor, paint, sheetrock, insulation – but they wouldn’t pay for the removal of the exterior sheeting. In this case, because it was an old problem caused by poor construction performed by an unlicensed contractor, it turned into an expensive lesson.