Know Your Insurance Policy

This month features knowing your homeowners insurance policy to prevent disappointment, frustration, and devaluation of your property.

Scenario:

Ann and Frank knew the storm was coming and that there was a possibility of damage, but what they didn’t know is if their insurance policy would cover all the reparation costs. After the storm and a phone call to the insurance agent, the couple found out that they only had a quarter of the losses covered on their policy. I would like to tell folks to know their homeowners insurance policy inside and out. Here’s why…

* * *

Insurance is a rip-off until you need it, and when you need that is the wrong time to decide if you have been paying for the right coverage. Too often people find out after the accident, or the roof collapses, that they’re not fully covered for the types of damages incurred.

A few years back in July 2012, the valley in Ferry County, including Republic, Inchelium and Curlew, received severe windstorms. Republic was without power for a week and there was lots of widespread damage from fallen trees. One of my customers on the Little Twin Lakes at the Rainbow Beach Resort had 20 thousand dollars worth of insurance coverage for their lakefront trailer with an addition. After the storm, they found out it would cost them 80 thousand dollars to replace what they had. This is a prime example of the importance of making sure you know your insurance policy. Will your limits cover your losses?

‘Ordinance of Law’ or ‘Building Code Upgrade’

How many homeowners know what Ordinance of Law means? It’s also called Building Code Upgrade in insurance terms. A lot of homeowners pay out their whole life and never have a claim, but many people I’ve met in my industry don’t realize what Building Code Upgrade is until there’s a mishap at their dwelling. For example, if a roof collapses it can’t be rebuilt correctly without it being set at minimum code standards. Otherwise, the insurance companies will only cover ‘as it was built.’ Building codes are just the minimum accepted requirements for a building. That’s not common knowledge.

In last month’s Contractor Corner, I told the story of a 500 dollar job turned into a 60 thousand dollar job. This couple did have Ordinance of Law in their homeowners insurance policy. Their insurance company paid for the complete rebuilding of everything that was done wrong, and included all of my costs that were incurred to put their cabin back together right.

For under 10 dollars a month on most policies, homeowners can get the code upgrades, which means that when something is damaged and needs to be rebuilt, it has to be brought up to current building codes, and it doesn’t matter what it was built like originally within reason. That’s really important because a lot of times when a structure fails, I can’t put it back together legally the way it was because it was done incorrectly, and that’s why it fell in the first place.

Insurance is all about Home Value

Not all insurance companies are the same. Some companies advertise lower rates but what they don’t tell you is the corresponding lower benefits. From my experience, some companies nickel and dime every claim, and they will argue whether they are liable at all. If they are responsible they display reluctance in paying for full replacements. The reason that you have insurance is so that your property and your structures do not get devalued in case of an accident. If an insurance company replaces half of a roof and the roof doesn’t match anymore, that’s devaluing your structure because now it’s got two roofs on it that don’t match.

Some insurance companies do their job and pay out. All in all, some fight and some don’t. In my experience in dealing with insurance companies and residential building in the Tri-County area over the past 14 years, I’ve changed my insurance company, and I’m with a company now that provides the least amount of hassles with optimal benefits to the customer. And I know that I have Building Code Upgrade on my insurance policy. Check with your neighbors, who they go though and their experiences with their insurance company. Some of the most popular insurance companies can be the worst to do business with, and in the long run you can end up spending a lot of extra time, energy, stress and even money to negotiate with them.

Insurance companies don’t make money by paying us money. They pay adjustors to save them money and are usually promoted by the amount of money they save the insurance company. On average, adjustors come to your home, evaluate and often times want to cut you a check then and there. There’s a reason for this: they want to settle quickly. If a contractor gets involved, they have to pay an extra 20% for profit and overhead. The contractor will also do a full assessment, whereas the insurance company claims the bare minimum damage. Quite often there’s more damage done than what the adjustor assesses.

One time I was contracted by a real estate agent with a client who wanted to buy a new home. The home inspector noticed that the roof trusses were sagging. Two years prior, a home inspection was conducted and the roof was approved. In addition, both inspections were handled by the same inspection company. The seller claimed it on the insurance company to appease the new buyer, but the insurance company fought the claim tooth and nail. There were record snowfalls that winter of 2008-09 which obviously directly correlated with this new damage, but this was not enough for proof. Thankfully because of documentation recorded by the realtor, the roof damage was finally proven to be new. We almost had to go to court with the insurance company. We had all the documentation lined up and proof that the snow load caused the problems so in the end, that extraneous action was avoided.

The seller was finally able to contract with Wilder Construction LLC, to repair the damages. We tore the whole roof off, installed new energy-heel trusses that would carry the snow load and raised it two feet to accommodate the required insulation. We patched all the sheetrock on the inside of the house and added new siding on the exterior. It didn’t cost the homeowners that were selling the house any extra and the folks that bought the house got a whole new roof system with an upgrade of 15 inches of up-to-code insulation – over double than what was there prior – along with stabilizing the roof and making it level again. The seller also had the Ordinance of Law clause on their policy so they were able to do these upgrades without any out-of-pocket costs.

On the flipside, we just rebuilt a home that had a house fire. It was a complete loss and the loss was traumatic. We told our customer that we would do our best to make the transition as painless as possible, but I had not worked with their insurance company in the past, yet I was hopeful that they would be unproblematic. We built our customers a new home and their insurance company was the easiest to work with in my experience, so much so that I’m considering changing my insurance company again to that company because they handled all the transactions so smoothly.

Know Your Policy

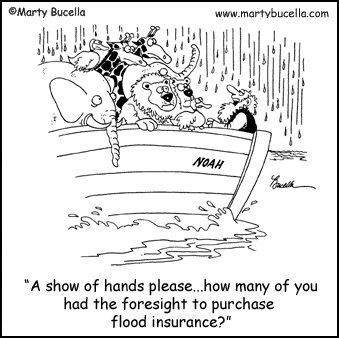

In our area we have plenty of natural disasters for homeowners to be concerned with, such as wind, lightning, floods, fires and frozen temperatures. Even freezing pipes can cause a problem. A pipe can freeze and split inside the wall; then when it thaws out, there’s a water damage issue at hand that can invite a remodel project from a range of costs.

Insurance is there to keep the value of your home. Homes are supposed appreciate in value, not depreciate in value. In the event of a claim or loss, your insurance company should keep the market value the same. Every homeowner needs to be aware of that so they can reason with the adjustor in an educated way.

Knowing your insurance policy can save a lot of potential disappointment, frustration and property devaluation. If you don’t know all the ins and outs of your insurance policy, I highly recommend going to your insurance company, sitting down with your agent and have the agent explain exactly what you have and don’t have on your policy. That’s what you pay for. I can sit down at my agent’s office and go over all my limits, my liabilities, what I’m covered for, all buildings that are covered, and if my limits cover all my potential losses.